We previously blogged about the unfair impact that the EB-5 Reform and Integrity Act of 2022 has on the thousands of Chinese and Vietnamese EB-5 investors who are stuck in the visa queue, waiting for their I-526 priority date to become current in the Visa Bulletin. In short: The new legislation reserves 32% of all EB-5 visas made available in each fiscal year to those who invest in rural areas (20%), high unemployment areas (10%), or in infrastructure projects (2%), and absent any action and coordination by USCIS and the State Department, these reservations will only be allocated to future EB-5 investors. As such, the total number of visas available to existing investors will likely be decreased, further extending the wait time for these investors and eligible family members.

Additionally, under the new EB-5 law, unused reserved visas are to “carryover” to immigrants in the same category for the immediately succeeding fiscal year. Any unused “carryover” reserved visas are to be made available to the “unreserved” visa category (existing investors and those who do not qualify for reserved visas under the new legislation) in the next fiscal year. DOS will also need to determine how these provisions interplay with the INA’s requirement that unused visa numbers in a fiscal year fall up from EB-5 to EB-1.

Confused yet?

We are seeking to determine how many EB-5 visas would be available in each reserved category, depending on whether DOS would allot unused reserved visas to the new “unreserved” visa category (existing investors and those who do not qualify for reserved visas under the new legislation).

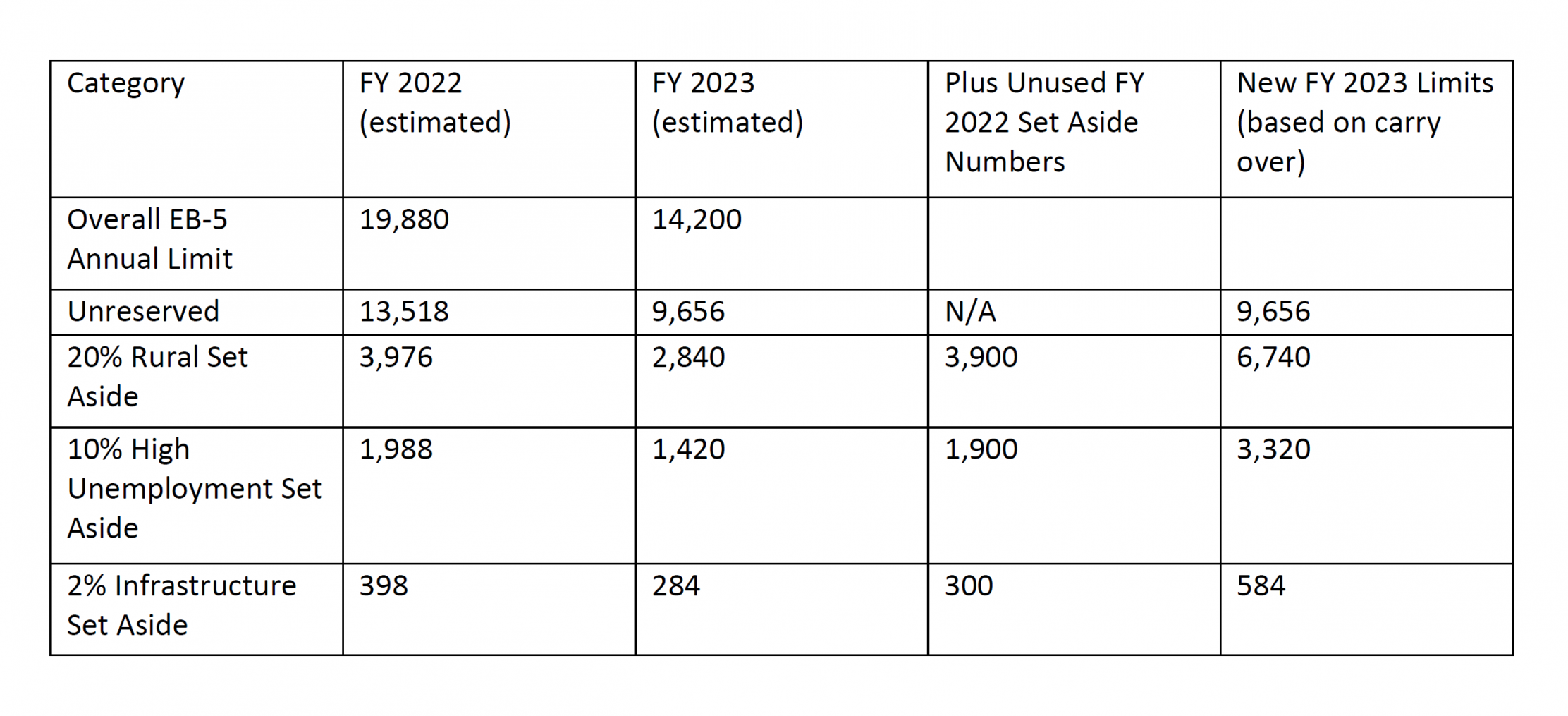

Notably, with USCIS’ decision to require a Form I-956 approval prior to any new Regional Center I-526 being filed, combined with USCIS’ pathetic processing times on EB-5 cases, it’s possible that few, if any, of these newly reserved visas could actually be used in FY 2022 and FY 2023. A decision by DOS to let the “leftover” reserved visas be allocated to existing investors would be most consistent with the INA’s directive in Section 203(b) to maximize visa number use under the applicable annual limits. On the other hand, if DOS follows the plain language of the EB-5 Reform and Integrity Act and ignores Section 203(b) to determine that “leftover” reserved visas be allocated solely to the reserved visa categories in the subsequent fiscal year, the visa number estimates are as follows:

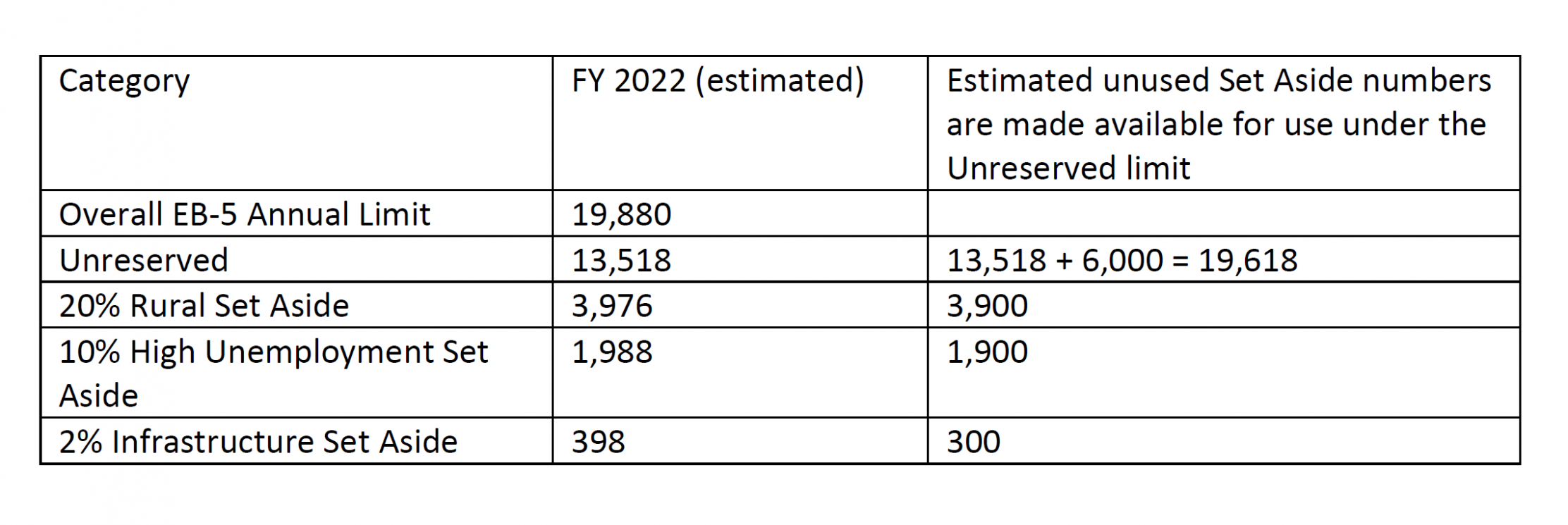

However, we believe that the application of the INA language which encourages the use of numbers under each year’s annual limits would not cause the State Department to intentionally allow numbers to go unused when there is pending demand. In such a situation, the visa number use would be as follows:

This determination will have dramatic impact on DOS’ ability to advance the Final Action Date for existing investors stuck in the visa backlog.

One solution could come from Congress, a five-year technical amendment to the INA to count only principal investors against the annual limit, and not including derivative beneficiaries. Congress has made similar exceptions in the past. In 2005, INA §204(b)(4) was amended to allow the admission of certain special immigrants who qualify as international broadcasters under the EB-4 preference category, and the provision explicitly excluded spouses and children from the numerical limit in the category. Congress also excluded derivative spouses and children from numerical limitations when it authorized the admission of Special Immigrant Translators or Interpreters from Iraq and Afghanistan in 2006.

This correction by Congress would be consistent in the language of the INA that Congress did NOT intend the annual numerical limitation to be diluted by non-investor family members who would otherwise qualify for derivative visas (“Visas shall be made available, in a number not to exceed 7.1 percent of such worldwide level, to qualified immigrants seeking to enter the United States for the purpose of engaging in a new commercial enterprise. . .”).

To hear more about this important topic, register for AILA’s EB-5 Reform and Integrity Act (RIA) Live Online Course.